Stewardship Code Annual Report & SRD II

PRINCIPLE 1

Signatories’ purpose, investment beliefs, strategy, and culture enable stewardship that creates long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society.

Polunin Capital Partners Limited (‘PCPL’, ‘the Firm’, or ‘Polunin Capital Partners’) manages assets for a range of institutional clients including pension funds, endowments and commingled investment funds. The Firm only invests in Emerging Market and Frontier Market equity securities. Investments in UK and European equity securities (which derive the majority of their revenues from, or have significant investments in, Emerging or Frontier Markets) form a small part of the Firm’s investment universe.

The Firm’s guiding principle is to maximise the long-term economic value of clients’ holdings, using a proprietary replacement value methodology that has been successfully applied and refined over decades and through various cycles. As long-term investors, the sustainability of investees’ business models is important to valuation, and issues such as climate change, resource constraints, diversity, and gender equality create risks and opportunities in our investment universe. Incorporating Environmental, Social and Governance (‘ESG’) criteria into our bottom-up investment process enables us to make better risk-adjusted investment decisions.

PCPL believes responsible investment can make a significant contribution to our fiduciary duty to our clients. Issues such as equality, sustainable development, and climate change affect not only societies, but potentially the long-term performance of companies, and outcomes for financial assets. The Firm’s philosophy is to focus on direct engagement with a view to affecting operational changes that result in improvements to ESG factors that in turn will act as positive catalysts to share price performance.

Since 2019 our investment team, as part of our research process, has been performing in-house ESG scoring for all of our portfolio companies. Our scoring process assesses a company on a wide range of ESG issues – from climate change to human rights and diversity, which are mapped to the United Nations Sustainable Development Goals (‘UN SDGs’) and are incorporated into investment analysis and active ownership when they are material. We seek to understand the current and future ESG risks and opportunities of a company, and how they affect a company’s potential to reach fair value.

We became a signatory of the United Nations-supported Principles for Responsible Investment (‘UNPRI’) in Dec 2020, and fully revised our Responsible Investment, Climate Change, Proxy Voting, and Exclusion Policies in early 2021, to demonstrate our commitment to investing responsibly.

We monitor the progress and continue to improve our ESG and stewardship processes. For example, since our first UNPRI assessment, we have published our proxy voting on a quarterly basis, and our engagement report is now issued semi-annually. The format has been further improved after feedback from clients on their requirements on stewardship reporting. More recently we obtained an exemption from exclusion by a client based on our engagement efforts. Although most clients have not requested reporting on carbon emissions, we perform climate impact assessments, including carbon emission exposures, attribution by sector and company, climate scenario alignment analysis, and assessment of climate transition and physical risks, all of which are disclosed in our first TCFD report of 2022. We have also noted client enquiries on biodiversity and water usage, and we monitor the development of standards and methodologies in order to meet clients’ growing expectations.

We are mindful of the risk that investment ‘style drift’ can arise from pursuing a too prescriptive, exclusion-based application of stewardship principles, which is why we prefer a methodology focussed on engaging with investee companies on ESG matters. We believe that this approach best serves the interests of our clients, who are mainly well-informed institutional investors; the feedback we have received has been broadly supportive.

PRINCIPLE 2

Signatories’ governance, resources and incentives support stewardship.

ESG & Stewardship governance structure

The PCPL Board of Directors has oversight of the company’s strategy and investment objectives and has ultimate responsibility for ESG integration into the investment process and portfolio construction.

Our responsible investment methodology, policy and reporting are overseen by the ESG & Sanctions Screening (‘ESGSS’) Committee, which is chaired by our CIO, with 7 members from the investment, compliance and client service teams. The ESGSS Committee oversees the responsible investment policy development and the methodology for implementing ESG processes in the investment process. At its inception, the ESG Committee (as was) met on a quarterly basis. However, during 2021, as the number of ESG topics and sanctions matters grew rapidly, the remit of the Committee expanded to include the sanctions regime, and the frequency of its meetings increased to monthly in order to enable more effective decision making and action.

Our 15 investment professionals groupwide are responsible for the ESG scoring of their sector and company coverage, and for proxy voting recommendations, and leading engagement with companies. Portfolio companies’ ESG scores are reviewed annually. In late 2021, after reviewing client feedback and benchmark updates, we revised the internal scoring methodology to incorporate Climate Action 100+ initiative (‘CA100+’) Net Zero Benchmark disclosure indicators, and elements are mapped to the UN SDGs.

Within our investment team there is a nominated ESG analyst, who has achieved the CFA Certificate in ESG Investing. The ESG analyst supports our CIO in the continued integration of ESG into the management of our portfolios, drawing upon their expertise and knowledge, keeping abreast of new ESG developments and policies, and delivering ongoing ESG training in-house. ESG training is provided to members of the investment team and client service team.

The compliance team is responsible for oversight of stewardship activities, ensuring that independence is maintained, and proxy voting guidelines are followed. Compliance monitors and ensures that investment processes and products comply with regulations and investment management agreements.

We use a number of ESG data providers, primarily ISS for controversy data, carbon emissions, climate scenario analysis, transition and physical climate risks analysis, supplemented by CDP for environmental disclosures, and Refinitiv as a second source reference for ESG scores.

PCPL’s remuneration policy aims to align compensation with the interests of clients and long-term performance of the Firm. The Firm’s founders and controlling stakeholders only tolerate a low level of risk, and deferral of variable remuneration is employed to discourage risk-taking. Each individual’s performance assessment includes consideration of their compliance with internal policies and procedures alongside their contribution to the strategic objectives of the Company. Polunin Capital Partners is committed to incorporating ESG considerations into the management of our portfolios with the approach documented in our policies. The Board of Directors takes ultimate responsibility for the integration of these policies into our portfolio management process. Our remuneration policy captures ESG risk by way of the policies and procedures which employees of the Firm are bound to respect. Compliance with internal policies and procedures forms a part of annual fit and proper assessments (applicable to FCA Code Staff and Senior Managers) as well as performance reviews.

PCPL considers diversity as key to our operational sustainability. We offer flexible working opportunities which we feel attracts a wider range of applicants to the Firm. Prospects are interviewed by most members of staff before an offer is made, ensuring diversity in the selection panel. Most of the expected growth in staffing will be in the investment team where the benefits, particularly of ethnic diversity, to the investment process have been self-evident to the Firm for many years. Diversity, including skills, experience, ethnicity and gender is important at the Board level. The Group has promoted two female members of staff to Director level within the past few years. There is scope to increase further the existing gender and ethnicity diversity on our Boards, and we see scope for this diversity to increase further as senior members of the team are promoted up into Board positions.

Through the monthly ESGSS Committee meetings we continually assess the effectiveness of our governance structures and processes, and review whether internal requirements and client expectations are being met. We plan to increase our spend on ESG data purchases from third party specialist ESG data providers to support our ongoing engagement and stewardship initiatives.

PRINCIPLE 3

Signatories manage conflicts of interest to put the best interests of clients and beneficiaries first.

PCPL is a privately owned company, in which the majority of staff own an equity interest, and in which the original founders and majority shareholders are closely involved in day-to-day management. PCPL recognises the importance of managing potential conflicts of interest on behalf of its clients when voting their shares and engaging with investee companies. PCPL will consider all potential conflicts of interest that it identifies, or which are brought to its attention, and will determine if a material conflict of interest exists. Our principal objectives when considering matters such as engagement and voting are always to act in the best interests of our clients and to treat them fairly.

The Firm’s Compliance team and Board is responsible for implementing systems and controls designed to review potential and actual conflicts of interest on a quarterly basis. Conflicts can arise when the Firm:

- Is likely to make a financial gain, or avoid a loss, at the expense of a client (including the funds managed by the Firm and their investors);

- Has an interest in the outcome of a transaction carried out on behalf of a client, distinct from the client’s interest in that outcome;

- Has incentive to favour the interests of one client over another;

- Carries out the same business as the client; or

- Receives or will receive an inducement from a person other than the client in relation to services provided to the client in the form of monetary or non-monetary benefits or services.

Policies and procedures relating to Conflicts of Interest are available on the Firm’s website https://polunin.co.uk/conflicts-of-interest-policy/. If a potential conflict is identified, business functions will be segregated to maintain independence and to prevent the identified conflict from crystallising. This may include information barriers, separating functions and adding supervision, or reassigning functions altogether.

All staff receive training and are required to give a quarterly undertaking confirming their understanding of the Firm’s conflicts of interest policy, including disclosing any personal conflicts such as their personal trading activities, the receipt of gifts, benefits or entertainment and outside business interests.

Staff members are required to obtain prior approval from Compliance before engaging in any employment outside of their employment with the Firm. Staff members are also required to obtain the prior approval of Compliance before taking an interest in any outside business organisation, and in particular before becoming a director, an officer or adviser to a company or any other entity whether or not it is a paid position.

The review of conflicts of interest is dynamic, with the Compliance team raising any perceived or potential issues with senior management at the Firm whenever they arise; and as a standing item at the Firm’s regular quarterly Board meetings.

Potential conflict case study 1: Chief Investment Officer’s personal holdings in two of the Firm’s investment products.

How it would be addressed: We continue to monitor and manage carefully any potential conflicts of interest arising from senior management and client investors’ overlapping investment. Aside from measures to mitigate the risk of single-person bias in trading and investment activity, any potential conflicts with other shareholders on proxy voting matters are mitigated by the Compliance team having oversight of exercising the proxy voting.

Potential conflict case study 2: an analyst or fund manager is made insider in the course of discussion with a company.

How it would be addressed: Pre-trade restrictions are added to the trade management systems and personal account dealing register. The Compliance team confirms with the analyst or fund manager once the information is made public before removing the restrictions.

PRINCIPLE 4

Signatories identify and respond to market-wide and systemic risks to promote a well-functioning financial system.

PCPL’s investment methodology is bottom-up and focused on the fundamental value of a company using industry valuation techniques. There is no formal integration of macro-economic and geopolitical analysis in this process. However, as the valuation comparison of companies across emerging markets uses the US Dollar as a common currency, macro risks and events can be captured through changes in FX rates and their effect on the relative valuation. By example, a company’s valuation relative to its peers will become more expensive if its local currency strengthens appreciably against the US Dollar (which will in turn be a function of top-down economic or political factors).

The possibility of political or social instability, or diplomatic developments could affect investment in certain countries. There are also varying levels of government supervision and regulation of exchanges, financial institutions and issuers in various countries. In addition, the way foreign investors may invest in securities in certain countries, as well as limitations on such investments, may increase the volatility and risk of loss to investments.

Managing regulatory risks: In 2022, the risk of investing in a sanctioned entity became more nuanced. While the pace of change in listed companies facing direct financial sanctions eased somewhat over the year, the spotlight fell instead on rising numbers of Specially Designated Nationals (SDNs) being added to sanctions lists. As a result the risk to the Firm of investing in a company in which an SDN held a controlling interest also rose, and therefore a decision was taken during the year to increase the frequency of our sanctions screening (using the Refinitiv Worldcheck database) from monthly to weekly. The ESGSS Committee continues to review findings and consider proposals for action to be taken, and with the Compliance team will ensure any decisions are communicated to, and enacted by the relevant business areas in the Firm.

Managing sustainability risks: Emerging markets typically have greater exposure to sustainability risks than developed markets. Listed companies in emerging markets are often subject to less extensive sustainability-related reporting requirements making it challenging for the Firm and external providers to identify and assess the materiality of inherent sustainability risks. The assessment of sustainability risks of investees is carried out on a bi-annual basis, the results of which are summarised and reviewed by the ESGSS Committee, to integrate into the investment decision-making, and monitor potential or actual material risk to long-term risk-adjusted returns. We summarise sustainability risks in our investment universe as follows:

- Climate change management is at an early stage in emerging markets, most countries are at the beginning of establishing targets and action plans to reduce environmental impact, and government implementation and enforcement of policies to limit climate impacts are often lacking or non-existent. Climate impacts may include greenhouse gas emissions and climate change, water stress, biodiversity and deforestation, emissions and waste both toxic and non-hazardous, and environmental management in the supply chain.

- Countries in emerging markets often lag developed markets in respect of labour and human rights practices, child labour, equal opportunity and pay, freedom of association, sexual harassment, occupational health and safety, code of ethics and conduct, confidentiality for whistle-blowers, anti-bribery and corruption, and supplier monitoring in respect of the aforementioned practices. There can be gaps in consumer rights and protection, including product quality assurances, prevention of mis-selling, monitoring inappropriate online content and behaviour, and consumer data protection, privacy and cybersecurity.

- Governance risks may be more pronounced in emerging markets owing to less developed corporate governance frameworks, and a lack of legal protection or redress for stakeholders and minority shareholders.

The analysis performed in support of our TCFD reporting has focused our attention on engaging with investee companies to encourage the setting of medium-term emission reduction targets, as the alignment level remains low in emerging markets. Given our value-oriented investment style, the portfolio is naturally tilted towards carbon-intensive, hard to abate sectors such as materials (chemicals, steel, cement, aluminium), and transportation (aviation, shipping, aviation). While we have seen some rapid progress in developing low carbon technologies amongst our investees, we will continue to engage with investees on targets that will align with energy transition.

It is worth noting that the quantification of physical climate risks remains a challenge for our investees, and also for us at a portfolio level, due to the lack of detailed geospatial data, and difficulty in modelling extreme weather patterns.

Participation in industry initiatives: In June 2022, we co-signed with 7 other asset owners and managers, two AGM statements to Industrial and Commercial Bank of China and Bank of China, a collective effort led by Asia Research and Engagement. Both letters requested clearer financing policies in respect of coal-fired power, recommending that these be aligned with China’s twin carbon targets, effectively phasing out unabated coal-fired power by 2045 to meet a carbon neutrality target by 2060, in accordance with pathways developed by the International Energy Agency in response to invitation by the Chinese government.

As an investor signatory to Workforce Disclosure Initiative (‘WDI’), conducted by ShareAction, an annual survey and engagement programme to provide data on workforce practices, we gained practical insights on how to engage investees on managing human and labour rights issues in the supply chain. In 2022 one of our investees became one of the first Chinese companies to participate in the survey, which was an important step in increasing transparency in human and labour rights disclosure, and improving risky perceptions of emerging markets companies. We also joined PRI’s Advance stewardship initiative on human rights in 2022.

Going forward, we will focus our efforts on:

Identifying and managing climate risks, both transition and physical. To increase the proportion of portfolio companies that are climate resilient and transition aligned, we will engage with companies to focus on setting interim carbon reduction targets

Sustainability processes and reporting, encouraging companies to improve material sustainability processes and disclosures.

Governance best practices, improving independence of board structures and diversity at board and senior management levels.

PRINCIPLE 5

Signatories review their policies, assure their processes and assess the effectiveness of their activities.

PCPL’s long-term investment horizon is intertwined with our approach to stewardship, looking to enhance investor’s value through engagement with our portfolio holdings to minimise reputational and stranded asset risk arising from ESG factors. Our approach, policies and reporting are overseen by the ESGSS Committee, chaired by our CIO, and reporting to our Board of Directors which ensures the implementation of responsible investment at the Firm.

The Firm’s ESGSS Committee meets formally on a monthly basis, or whenever more urgent action needs to be considered. This allows for timely review of updates from our sanctions screening, as well as greater responsiveness to outcomes from norms-based and exclusionary screening. Engagement with companies on ESG and proxy voting matters, including collaborative efforts with other investors, are also discussed at the meetings.

The ESGSS Committee has also increased its number of members to seven including portfolio managers, representatives of the investment, compliance, and client services teams. It regularly invites guest attendees to report to the Committee and lend specialist insights, and also to promote the Firmwide understanding of ESG goals and objectives.

As a signatory of the UNPRI, we are assessed annually on an ongoing basis. The Firm’s stewardship policies are reviewed annually by the ESGSS Committee and approved by the Compliance team, to ensure that they are fair and balanced, and that best practices and up-to-date climate guidelines are adhered to. Our responsible investment and ESG policies are published on our website and are made available to all members of staff.

Stewardship reporting (quarterly proxy voting reports and semi-annual engagement reports) are written in plain English and are subject to review and approval by the ESGSS Committee. Once approved they are published on our website (www.polunin.co.uk) and are available to all members of the public.

PRINCIPLE 6

Signatories take account of client and beneficiary needs and communicate the activities and outcomes of their stewardship and investment to them.

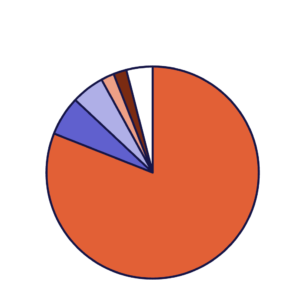

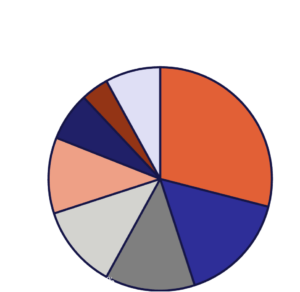

PCPL manages assets for a range of professional clients including pension funds, endowments and comingled investment funds. Below is a breakdown of our clients by geography and type as at 31 December 2022:

Our client base is predominantly US based (81%), with significant investment from institutions in Singapore (6%) and Saudi Arabia (5%). We are more diversified in terms of institutional client type with public pensions, wealth managers and endowments representing 58% of our total assets under management (‘AUM’). Private pensions, sovereign wealth funds and foundations are the primary source of the remaining balance, representing a further 30% of our AUM. PCPL’s invested AUM is over 99% in emerging markets listed equities.

All the Firm’s investment strategies are underpinned by a common, deep-value investment methodology and process, which is best suited to a longer-term investment horizon (3 to 5 years). The deep-value philosophy is aligned with our stated goal of seeking ESG improvements in investee companies over multiple years, a process that requires investment analysts to engage regularly with the companies they are responsible for valuing. Our deep-value investment style tends to have a higher weighting on hard-to-abate sectors, and emerging markets companies often have to contend with national energy policies that do not always align with the energy transition expectations of investors from developed markets. Our engagement with investees often involves educating them on investor expectations and urging them to implement a reporting roadmap. The decarbonisation dilemma in emerging markets is generally well understood by clients, but portfolio risks need to be well-managed, and engagement with companies forms an important part of stewardship.

PCPL also runs segregated mandates that are tailored to individual clients and their specific stewardship and investment policies, with additional ESG approaches in operation to suit client needs.

In 2022 there were no cases where we did not manage assets in alignment with clients’ stewardship and investment policies.

We also monitor ESG and stewardship related questions and topics arising within RFPs, with these feeding into wider discussions on areas where our stewardship activity and reporting may have scope for improvement.

Our client services team meet with our clients regularly in performance reviews and due diligence meetings, answering any ESG and stewardship related queries that may arise. During the past year, a number of the Firm’s clients have sought more detailed information on proxy voting, and the rationale behind our voting decisions where we have voted ‘Against’ management resolutions. To promote greater transparency in this area and evidence compliance with our stewardship obligations we initiated quarterly proxy reporting on our website. Our proxy voting template was shaped by client requirements. The reports contain two sections: the first shows a summary of the number of meetings and resolutions voted during the preceding quarter, plus additional metrics including the number and proportion of votes cast ‘Against’ or ’Abstain’. The second section provides detail on those votes that were cast ‘Against’ or ‘Abstain’, including company names, the resolutions of concern, how we voted, and the rationale behind the voting decision. This section also shows whether we communicated our voting intentions to the company ahead of the vote, and what the eventual overall outcome of the vote was.

The Firm engaged the services of Glass Lewis in December 2022 to enhance its proxy voting capabilities. This service better facilitates the provision of more detailed disclosure and reporting to our clients as it allows the Firm’s investment analysts to directly upload their voting recommendations and, more importantly, the rationale for those recommendations for the investee companies that they follow.

PRINCIPLE 7

Signatories systematically integrate stewardship and investment, including material environmental, social and governance issues, and climate change, to fulfil their responsibilities.

Our core asset class is listed equities, comprising approximately 99% of invested AUM, and it is important to note that our approach to the integration of stewardship through engagement does not differ across our clients, asset classes or geographies.

Company level ESG analysis (monitoring through holding and exiting) and engagement (monitoring through holding and exiting) are conducted by the investment team directly; we do not have a separate sustainability research team. The lead analysts are responsible for both financial and ESG analysis, and engagement of investees. We ask analysts to focus on:

- Companies’ environmental and social policies, processes and disclosures, focusing on material risks of particular sectors, e.g. water use in the semiconductor industry, human rights in the construction industry;

- Whether past controversies have been addressed through improvement in processes; and

- Companies governance structure and historical track record.

Whilst we have developed our own methodology to score and analyse companies on ESG matters, we use external research to monitor ESG related controversies. This includes both normative issues such as human and labour rights, and revenues from controversial areas such as controversial weapons, and forms the screening prior to investment. Companies with verified failure to respect established norms are excluded for investment. Existing investees undergoing remediation or that have alleged failures are prioritised for engagement. (Please refer to the Exclusion Policy on our website for exclusion criteria).

We have identified Coal Exit as an engagement priority, due to the significant stranded asset risk associated with a long-term investment horizon. Portfolio companies deriving 10% or more of their revenue from thermal coal-related activity have been identified. In 2022 we continued engagement with Banpu in Thailand, and PGE in Poland, and Glencore, as part of the 3-year engagement process with coal-related investees on their commitment to a Coal Exit strategy.

Similar to our previous discussion with Tauron Polska, PGE indicated that the creation of a national energy agency in Poland (“NABE”, which would own all the lignite mines, hard coal and lignite-fired generation assets in Poland) was still under development and pending EU approval. Following the coal assets spin-off, PGE would focus on the transition of the remaining lignite-fired heating assets. We continue to engage with our Polish utility holdings to monitor progress.

Our meeting with Glencore focused on their transparency in reporting carbon reduction, capex plans and a coal production profile that did not align with their Net Zero by 2050 target, and the underreporting of fugitive methane emissions, as highlighted by shareholder advocacy organisation Australasian Centre for Corporate Responsibility (‘ACCR’) and subsequently reported by Bloomberg. The lack of transparency paired with continuing coal mining expansion, in spite of stated climate commitments, were part of the reasoning behind our decision to divest.

The issues identified during the internal scoring process form the basis of the engagement discussion with investees. In addition, the process of producing periodic ESG reporting to clients, and filling in requests for proposals, provide feedback on clients’ focus topics in sustainability. From these sources, we have identified the following sustainability outcome objectives:

- Encourage companies to report in accordance with the TCFD framework, including setting a Science Based Target, conducting scenario analysis;

- Consider physical risk factors and adaptation measures;

- Endorse adaptation strategy to lower water consumption;

- Coal dependency phase-out plan by 2040 at the latest; 2030 in OECD;

- Transparency on pay equality;

- Incorporate policies to address diversity and advancement to senior management positions;

- Transparency on measures that show oversight on labour and human rights at the company, as well as suppliers and contractors levels.

We believe the above topics will become more material to investors over time, and therefore it is paramount that investees have policies in place and improve disclosure on such matters. Furthermore, weakness in ESG matters could foretell risk of controversies, so the engagement process with companies acts as part of our risk management process.

Regarding climate engagement, we are a supporter of TCFD, a signatory of UNPRI and a participant of CA100+. .

As an investor signatory to WDI — an annual survey and engagement programme to provide data on workforce practices — we have gained practical insights on how to identify and address workforce issues, a pressing but under-addressed area in emerging markets.

PRINCIPLE 8

Signatories monitor and hold to account managers and/or service providers.

Whilst we have developed our own methodology to score and analyse companies on ESG matters, we use external research to monitor ESG related controversies. This includes both normative issues such as human and labour rights, and exposure to controversial areas such as controversial weapons. We also utilise third party data and estimates on carbon emissions. We conduct review on external ESG research providers on an annual basis, to understand changes in methodologies and research focus areas. . The discussion has been on climate scenario alignment that needs to be updated to the International Energy Agency (‘IEA’) 1.5°C scenario, and the presentation of physical climate risk analysis that is difficult to understand, by sector and geographic attribution. We have since received updates by our provider to show net zero scenario analysis, however on physical climate risk we continue to review research providers with regional downscale climate models. The additional difficulty for our diversified small mid cap portfolio is the availability of corporate geo-location data which limits the physical climate risk coverage.

For 2022 as a whole, the Firm did not engage proxy advisors . This stems from our small/mid-cap emerging market focus, where we believe service provision is typically limited in coverage or depth of knowledge.

However in December 2022 the Firm engaged the proxy voting services of Glass Lewis in order to meet increasing client voting disclosure requirements. Aside from the enhanced reporting capability available with this platform, the Firm will in the year ahead be able to review Glass Lewis’ own voting recommendations as part of its decision-making, which could prove especially helpful in those markets where, for instance, information on individuals seeking Board nomination is sparse.

PRINCIPLE 9

Signatories engage with issuers to maintain or enhance the value of assets.

Regular company meetings with investee companies are an important part of the Firm’s investment philosophy and provide the opportunity to discuss issues that affect corporate values with their senior management. Engagement on ESG issues builds on this by minimising risks through identifying and mitigating material ESG issues, and strengthen investees by improving processes, transparency, and reliance.

Engagements with portfolio companies can be summarized as follows:

- Company specific monitoring (bottom up): the Firm has introduced a responsible investing component to the range of questions investment analysts ask of investee companies with a view to scoring them on ESG factors. The analysts now work with portfolio companies to improve how they manage or disclose ESG performance or issues, as identified in the internal scoring and screening processes, or in response to events or queries. Investee companies are prioritised by the level of risk and size of position.

- Strategic engagement priorities (top down): we review and outline the engagement priorities on an annual basis, taking into consideration material issues for our companies, clients’ focus topics, and market and regulatory developments. The current priorities are Coal Exit, TCFD reporting, carbon reduction target setting, and supply chain labour and human rights monitoring. We identify the companies most exposed to these topics for engagement, priority being larger positions and larger companies who are more likely to be able to promote leading practice in the sector.

- Proxy voting engagements: whilst the vast majority of proxy voting issues are related to governance in our investment universe of emerging market listed equities, it is often the best opportunity to discuss governance structures and social-related matters with companies, prior to voting, and also throughout the year.

Engagement is an important part of the investment process for listed equities, which accounts for over 99% of our invested AUM. Engagement does not differ across strategies or geographies. As the investment team carries out engagement activity directly, we can combine the monitoring of ESG risks with our nuanced understanding of companies’ operations and sector issues. The investment team engages as part of regular meetings with companies, through face to face or virtual meetings, phone calls, and emails, or taking part in collaborative engagements organised by NGOs. We maintain records of our engagements internally, the progress of which are regularly reviewed by the ESGSS Committee. If progress has stalled then matters are escalated.

We had 8 engagement meetings in 2022, of which 5 were undertaken by external providers in collaborative engagements; 3 company engagements were ongoing, and 4 had concluded. As we defined engagement as purposeful communications with specific objectives, general ESG reviews with companies had been excluded, and this led to the low number of engagements. As we refine our approach we aim to increase the number of engagements over time.

Case Study – Banpu: in early 2021 Polunin established a Coal Exit Policy as part of the Climate Change Policy, requiring all thermal coal-related investees to establish a coal phase-out plan by 2030 in OECD countries, and 2040 worldwide, within 3 years from our initial engagement. In April 2021 we first engaged with the management of Banpu, including the CEO, on the need to transition out of coal. Over the course of 2022, we met with management and IR team, followed by email and phone communications, as we pressed the management to articulate more measurable and concrete targets on Coal Exit. The company announced targets and commitments including:

- only maintain operations in their current coal assets during duration of mine life, with zero allocation towards any capital investments in their mining operations;

- continued investments in renewables, electric vehicles, and other alternative energy assets;

- GHG emission reduction between 2021 and 2025 by 7% in mining, and by 20% in power generation;

- publication of the first TCFD-aligned report in 2023;

- conducting scenario analysis, including one aligned with the 2°C pathway;

- appointment of an ESG Committee with board representation;

- establishing business targets in line with environmental UN Sustainable Development Goals (‘SDGs’).

We are encouraged by the positive steps Banpu has taken in the decarbonisation journey, as we continue to evolve our engagement approach and encourage more companies to take concrete action to decarbonise in the coming year.

PRINCIPLE 10

Signatories, where necessary, participate in collaborative engagement to influence issuers.

The Firm often engages on issues of concern directly with the company, as we believe such an approach is better suited to smaller capitalisation companies where we can be one of the larger minority shareholders. However, in some circumstances, particularly with larger companies and on sector or policy issues, collaboration with other investors can be the most effective way to engage. This could be in situations where independent escalation has not produced a desirable outcome or during times of significant corporate or economic stress.

As a Firm we believe there is strength in numbers when it comes to engaging with our holdings on certain topics, and for this reason we have chosen to join several collaborative engagement organisations.

The Firm is a signatory to the UNPRI and the CA100+, and publishes support for TCFD and the Paris Agreement on climate change. We are also a member of the WDI.

In June 2022, we co-signed two AGM statements to Industrial and Commercial Bank of China (‘ICBC’) and Bank of China (‘BoC’); a collective effort led by Asia Research and Engagement (‘ARE’). Both letters requested clearer financing policies on coal-fired power that are in line with China’s twin carbon targets, effectively phasing out unabated coal-fired power by 2045 to meet a carbon neutrality target by 2060, based on study by the International Energy Agency (‘IEA’) undertaken with Chinese authorities.

The WDI aims to increase transparency around workforce practices by encouraging companies to report data on topics such as decent work and human rights. We have actively engaged with our holdings, as we believe the need for emerging markets corporates to align their workforce practices to international standards will only become more pressing over time. In 2022 we contacted Arcelik, ASMPT, Cemig, LG Electronics, Penoles, Sun Art, from which we successfully engaged ASMPT and Sun Art.

Sun Art Retail Group Ltd is a major grocery chain in China with 100,000 employees. Following a meeting with the head of IR at Sun Art and WDI’s engagement team, the company agreed to participate the 2022 survey, becoming one of the first Chinese participants in WDI. We hoped this would help inform and shape the company’s workforce reporting and practices going forward, and encourage other Chinese companies to participate next year.

PRINCIPLE 11

Signatories, where necessary, escalate stewardship activities to influence issuers.

The Firm undertakes a 3-year process of engagement, with escalation after 18 months at the latest. This may include publicly engagement with the board, withholding support on standard governance-related resolutions (such as director re-elections or approving the reports and accounts) or by filing or co-filing shareholder resolutions. If remediation remains inadequate or ineffective after the engagement process, the Firm will seek to divest its holdings.

As part of our monitoring of ESG risks we compile a restricted list of companies with verified breaches of the global norms or verified involvement in controversial weapons. In 2021 we found four portfolio holdings with alleged breaches. This triggered a 6-month engagement process to verify prior to divestment.

One of those holdings, Elsewedy, is an Egyptian contractor involved in a Tanzanian Hydropower project expected to impact the neighbouring UNESCO World Heritage site, the Selous Game Reserve. Following an initial meeting with the company to request the disclosure of the remediation measures being undertaken to mitigate the environmental impact of the project, Elsewedy requested that we sign a non-disclosure agreement (‘NDA’) before providing us with a remediation report. Given the limitations imposed by an NDA, the offer of information was not felt by the Firm’s ESGSS Committee to be equal and open and such was treated as non-disclosure. This triggered divestment of the position to comply with our policies.

PRINCIPLE 12

Signatories, where necessary, escalate stewardship activities to influence issuers.

The Firm undertakes a 3-year process of engagement, with escalation after 18 months at the latest. This may include public engagement with the board, withholding support on standard governance-related resolutions (such as director re-elections or approving the reports and accounts) or by filing or co-filing shareholder resolutions. If remediation remains inadequate or ineffective after the engagement process, the Firm will consider whether the residual ESG risk is significant enough to trigger a divestment.

Whist the escalation approach is uniform across funds and geographies as long-term investors in emerging markets equities, we are mindful of the cultural sensitivities, and the need for long term co-operation, whilst maintaining independence and avoiding conflict of interest. In the past year escalations have been in the form of voting against directors on governance-related resolutions, and in some cases, divestments. We try to find different avenues to engage with companies, through alternative contacts or collaborative platforms, to keep the dialogue going. However, in cases where there is a significant deterioration in the ESG risk of the company, the position is considered for exclusion or divestment.

Case Study – KEPCO: As a participant in collective engagement with Korea Electric Power Corp (‘KEPCO) through CA100+, and well as in one-on-one meetings, we have been sharing our concerns regarding the company’s ongoing investment in coal-fired power plants locally and overseas. For years KEPCO showed no change in strategy. To escalate the issue, CA100+ investors wrote a public letter to the Presidential Committee of Carbon Neutrality of the South Korean government, who is KEPCO’s controlling shareholder, urging for more ambitious decarbonisation.

Following this investor engagement and escalation, KEPCO and its six subsidiaries have committed to carbon neutrality and a complete phase out of coal by 2050 following the development of national plans by the South Korean Presidential Committee on Carbon Neutrality. It has established a new Power Innovation Division, together with the Carbon Neutrality Strategy Department, to develop strategies and an action plan relating to carbon neutrality in the company. And in December 2021, it launched the “KEPCO Carbon Neutrality Promotion Committee” to discuss strategic directions and major policies for the generation sectors in achieving carbon neutrality in December 2021.

As KEPCO is the main electricity provider in South Korea, accounting for 37% of GHG emissions in the country, this investor engagement has helped set clearer targets and commitments for decarbonization efforts in Korea. However in 2022 with rising coal price and cost of living political pressures, the company’s financial health has worsened substantially, causing slow down in investments in renewable energy. We will continue to engage with KEPCO to monitor its decarbonisation efforts.

PRINCIPLE 12

Signatories actively exercise their rights and responsibilities

The Firm aims to vote all proxies on behalf of clients that permit it to do so. We do not use the service of proxy advisors, but on request we will discuss with clients the rationale of our decisions when they differ from those of their own proxy advisors. To publicly demonstrate our commitment to stewardship, we publish proxy voting summaries on our website on a quarterly basis.

Our proxy voting policy is aligned with our ESG criteria, which is applied to all companies in all funds. However individual country governance codes are often less demanding about board tenures and board diversity. In such cases the lead analyst making recommendations on the vote will take into account the company’s circumstances and general corporate governance track record. The lead analyst is also responsible for analysing and making recommendations on proxies regarding complex transactions and controversial votes, and will engage with the company before or after when possible. Members of the compliance team exercise oversight on the final voting decision.

We coordinate with custodians and our proxy voting service during the account set up process to ensure that ballots for all the shares we are eligible to vote are received in a timely manner. The custodians are linked to our proxy voting service such that ballots reflect up-to-date client/fund stock positions. We monitor any discrepancies which are dealt with by the custodians or ballot distributors.

None of our funds currently participate in stock lending programme.

In 2022, we voted 100% of the eligible 3,445resolutions in 399 meetings, of which 18% were voted either Abstain or Against. In total, we voted Against or Abstained in 622 resolutions, most of which were against board directors, from low levels of board independence, over-boarding, no audit or remuneration committee independence, or lack of board diversity. Another frequent reason for lodging Against votes was where no rationale was given by the company when seeking a general mandate for dilutive capital raising.

Our proxy voting policy and voting summary, including rationale on Against and Abstain votes, can be found on www.polunin.co.uk/#stewardship